Learning Center

How to Navigate the Canada Revenue Agency’s Notice of Assessment

Why the CRA Notice of Assessment Matters

Every Canadian taxpayer receives a CRA Notice of Assessment (NOA) after filing taxes. But for many, it feels like a confusing letter filled with numbers and technical jargon. Understanding your NOA is crucial—it confirms whether you owe money, will receive a refund, or need to address errors in your tax return.

If you’ve ever asked, “How do I read my CRA Notice of Assessment?” or “What does this mean for my RRSP and tax credits?”—this guide will walk you through everything step by step.

👉 At Taxease, we specialize in helping Canadians file taxes with confidence and interpret CRA notices correctly to maximize refunds and avoid penalties.

What Is a CRA Notice of Assessment?

Your Notice of Assessment is the CRA’s official response to your filed tax return. Think of it as your personal “report card” for taxes—it confirms what you submitted, highlights any corrections, and provides a summary of your tax situation.

Key Information on an NOA Includes:

Whether you’re getting a refund or owe taxes

Your RRSP deduction limit for the upcoming year

Carry-forward amounts like unused tuition credits

Any interest or penalties applied

Explanations of adjustments made by the CRA

How to Access Your Notice of Assessment

There are two main ways to check your NOA:

1. CRA My Account (Online)

Log in through CRA My Account

View and download past and current NOAs instantly

Faster than waiting for mail delivery

2. By Mail

Delivered a few weeks after filing taxes

Slower, but useful if you prefer physical copies

💡 Pro Tip: If you use NETFILE-certified tax software like the one from Taxease, you can receive your NOA through the Express NOA service—often within minutes of filing.

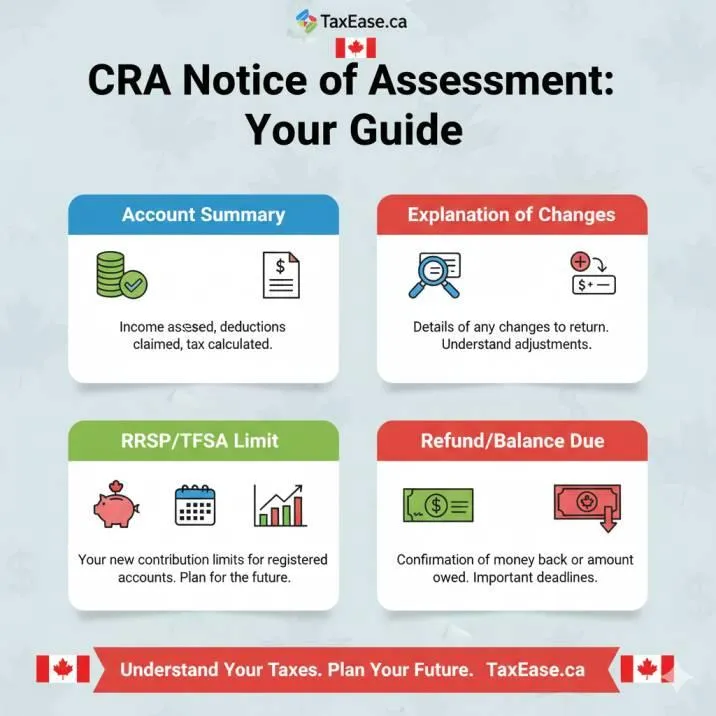

Breaking Down the CRA Notice of Assessment

1. Account Summary

Shows refund or balance due

Includes penalties and interest if applicable

2. Explanation of Changes

Details corrections CRA made to your return

Crucial if you see a different result than expected

3. RRSP Deduction Limit

Your maximum RRSP contribution room for the next tax year

Important for retirement savings planning

4. Carry-Forward Amounts

Tuition, charitable donations, capital losses

Helps reduce future taxes

Common Issues Found in an NOA

Even if you think you filed correctly, mistakes happen. Some of the most common issues include:

Missed or disallowed deductions (e.g., medical expenses, moving costs)

Incorrect RRSP contribution reporting

Tuition or education credits not applied

Miscalculated income if slips were forgotten

What to Do If You Disagree with Your CRA Notice of Assessment

Step 1 – Double Check Your Return

Compare your return with the NOA details. Sometimes the CRA is correct, and the error was on your end.

Step 2 – Call CRA for Clarification

A quick call can often resolve minor issues or confirm why adjustments were made.

Step 3 – File a Notice of Objection

Use Form T400A if you strongly disagree

Must be filed within 90 days of receiving your NOA

Starts the formal dispute process

🔗 Learn more directly from the CRA Notice of Objection Guide.

NOA and Your Financial Life

Your Notice of Assessment isn’t just a tax document—it has broader financial uses:

Mortgage Applications – Lenders often request your NOA as proof of income.

Student Loan Repayment – Confirms your reported income for repayment calculations.

Retirement Planning – Provides your RRSP room, essential for tax-deferred investing.

💡 Pro Tip: If you’re self-employed, your NOA may be one of the most important financial documents you’ll need for business loans or credit applications.

NOA vs Notice of Reassessment

Many Canadians confuse the two.

Notice of Assessment (NOA): Issued after your initial tax return filing.

Notice of Reassessment (NOR): Issued when CRA reviews your return again—either due to new information or a correction.

Avoiding CRA Penalties and Interest

Your NOA may highlight penalties or interest. To avoid this:

File on time (even if you can’t pay immediately)

Report all income (CRA cross-checks T-slips)

Keep receipts for deductions and credits

👉 Using Taxease ensures you claim all eligible deductions while filing on time, minimizing costly errors.

Quick Tips for Using Your NOA Effectively

Track your RRSP limit each year to avoid over-contribution penalties

Review the Explanation of Changes carefully—don’t ignore it

Keep digital and paper copies of NOAs for at least 6 years

Use carry-forward balances (e.g., tuition, donations) strategically

Making Your NOA Work for You

Your CRA Notice of Assessment is more than just a tax form—it’s a roadmap to maximizing your refunds, retirement savings, and future tax planning. Whether you’re checking your RRSP limit, disputing errors, or preparing for a mortgage application, understanding your NOA gives you a financial edge.

At Taxease, we make it easier for Canadians to file taxes, interpret NOAs, and unlock every deduction and credit available.

👉 Ready to take control of your taxes and avoid CRA surprises?

Start today with Taxease’s professional tax filing services for a stress-free, max refund guarantee.

TaxEase.ca is a Canadian tax preparation and accounting firm serving individual and corporate clients Canada-wide.

Useful Links

©2025 . All Rights Reserved.