Learning Center

Understanding Capital Gains Tax: What You Need to Know

Why Capital Gains Tax Matters in Canada

Selling your first investment property? Thinking of cashing out on stocks or mutual funds? Or maybe you’re passing down a family cottage?

In all these cases, the CRA Capital Gains Guide comes into play.

This blog post breaks down Capital Gains Tax Canada Explained—from how it’s calculated, exemptions you may qualify for, and common mistakes to avoid—so you can confidently handle your next tax return.

👉 At Taxease, we help Canadians like you minimize tax stress and make smarter financial decisions.

What is Capital Gains Tax in Canada?

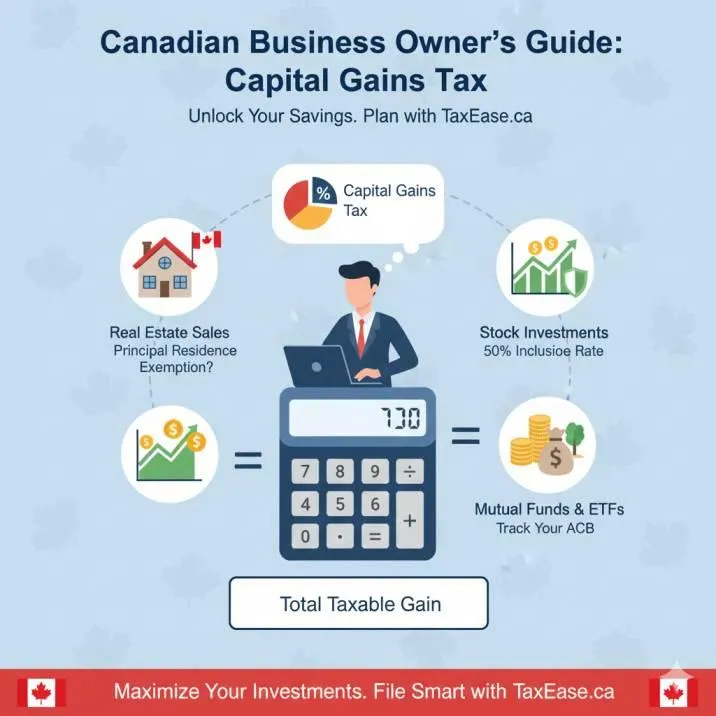

In simple terms, a capital gain is the profit you make when you sell a capital property (real estate, stocks, bonds, mutual funds, or certain business assets) for more than you paid.

If you bought a rental property for $300,000 and sold it for $450,000, your gain is $150,000.

But in Canada, only 50% of the gain is taxable—this is called the capital gains inclusion rate.

This means in the example above, $75,000 is added to your taxable income.

🔗 More details: CRA – Capital Gains

Key Terms You Must Understand

Adjusted Cost Base (ACB) Definition

The Adjusted Cost Base (ACB) is your starting point. It includes the purchase price plus transaction costs (legal fees, commissions, renovations on real estate, etc.).

👉 A proper ACB calculation ensures you don’t overpay on taxable gains.

Deemed Disposition Rules CRA

Even if you don’t sell a property, you might trigger capital gains when you gift assets, transfer to a trust, or die. This is known as a deemed disposition.

Exemptions & Special Rules

Principal Residence Exemption Canada

If the property you sell was your primary residence, the profit may be tax-free. However:

You must report the sale on your tax return (Schedule 3).

Only one property can be designated per year per family unit.

Vacation homes like cottages often do not qualify.

Lifetime Capital Gains Exemption (LCGE)

Selling Qualified Small Business Corporation Shares (QSBCS)? You may claim up to $1,016,836 (2024 limit) tax-free under the LCGE.

This is a huge tax planning opportunity for entrepreneurs considering succession or retirement.

How to Calculate Capital Gains in Canada

Step-by-Step Example

Selling Price – $600,000

ACB (Purchase + Costs) – $400,000

Capital Gain – $200,000

Inclusion Rate (50%) – $100,000 taxable

Add to Income – Taxed at your marginal tax rate

Using Capital Losses to Reduce Tax

Losses on stocks, real estate, or other investments can offset capital gains.

You can carry losses back 3 years or forward indefinitely.

🔗 Learn more: CRA – Capital Losses

Reporting Capital Gains on Your Tax Return

You report capital gains on:

Schedule 3 – Capital Gains (or Losses)

Net amount flows to line 12700 on your tax return.

For corporations, gains are included in the T2 corporate return.

💡 If you received capital dividends, these may be non-taxable but must be reported correctly.

Common Situations That Trigger Capital Gains

Selling stocks or mutual funds in a non-registered account

Selling rental or vacation property

Transferring property to a spouse or child

Cash-out of cryptocurrency investments

Sale of business shares

👉 Each case has unique CRA rules, so working with a tax professional like Taxease can prevent costly mistakes.

Strategies to Minimize Capital Gains Tax

Time the sale wisely – Selling in a low-income year reduces tax impact.

Use RRSPs and TFSAs – Assets sold inside registered accounts may avoid capital gains.

Claim capital losses – Don’t let them go unused.

Consider incorporation – CCPCs can access different tax rules and deferrals.

Estate planning – Transfer assets strategically to reduce deemed disposition tax.

Common Errors on CRA Capital Gains Reporting

Forgetting to include transaction costs in ACB

Misreporting principal residence exemption

Not carrying forward capital losses

Missing Schedule 3 reporting when exempt

Plan Ahead, Save More

Capital gains can feel overwhelming, but once you understand:

How they’re calculated

What exemptions apply

Which strategies minimize tax

…you’re well on your way to smarter wealth building.

👉 At Taxease, we simplify tax planning for Canadians—whether you’re selling property, managing investments, or running a business.

💡 Don’t wait until tax season stress hits—plan now and save later.

📩 Ready to maximize your tax savings and avoid CRA penalties?

👉 Book a free consultation with Taxease today and let’s secure your financial future.

TaxEase.ca is a Canadian tax preparation and accounting firm serving individual and corporate clients Canada-wide.

Useful Links

©2025 . All Rights Reserved.