Learning Center

Tax Implications of Selling Your Home in Canada

Thinking of selling your home? Learn the key tax implications for Canadian homeowners, including capital gains exemptions, reporting rules, and tips to avoid CRA penalties. ...more

Canadian Tax Tips & Planning

October 09, 2025•6 min read

Common Tax Mistakes and How to Avoid Them in Canada

Avoid costly tax errors this season. Learn the most common tax mistakes Canadians make and get expert tips on how to file accurately, save money, and stay compliant with the CRA. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

Year-End Tax Planning: Steps to Take Before December 31st

Prepare for tax season the smart way. Discover essential year-end tax planning steps every Canadian should take before December 31st to maximize deductions and minimize taxes. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

How TaxEase Simplifies Tax Filing with Certified Professionals

Discover how TaxEase helps Canadians file taxes stress-free. Our certified professionals ensure accuracy, maximize refunds, and handle everything from start to finish with ease. ...more

Canadian Tax Tips & Planning

October 09, 2025•3 min read

Understanding Capital Gains Tax: What You Need to Know

Learn how capital gains tax works in Canada. Understand what qualifies, how it's calculated, and strategies to reduce your tax burden when selling assets or investments. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

Tax Planning Tips for Canadian Small Business Owners

Smart tax planning tips for Canadian small business owners. Learn how to reduce taxes, claim deductions, and keep more profit with CRA-compliant strategies. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

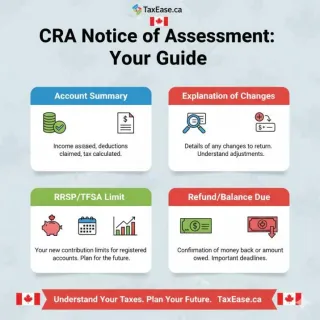

How to Navigate the Canada Revenue Agency’s Notice of Assessment

Confused about your CRA Notice of Assessment? Learn what it means, how to read it, and what to do next. Get expert help from TaxEase Canada today. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

RRSP vs. TFSA: Which Is Right for Your Retirement Savings?

Learn how to file taxes as a self-employed Canadian or small business owner. Avoid CRA mistakes and maximize deductions with expert help from TaxEase. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

Maximize Your Tax Refund: Top Deductions and Credits Canadians Often Miss

Discover the top Canadian tax deductions and credits most people miss. Maximize your refund this season with expert guidance from TaxEase professionals. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

The Ultimate Guide to Filing Taxes for Self-Employed Canadians

A complete guide for self-employed Canadians on how to file taxes, claim deductions, and stay CRA-compliant. Simplify tax season with TaxEase experts. ...more

Canadian Tax Tips & Planning

October 09, 2025•4 min read

TaxEase.ca is a Canadian tax preparation and accounting firm serving individual and corporate clients Canada-wide.

Useful Links

©2025 . All Rights Reserved.